How to choose the right payment gateway for your business

13 essential factors to consider when choosing a payment gateway.

Introduction

There are many factors to consider when creating an effective payments strategy. Among them: which payment methods will help you grow revenues? How can you design a payer experience that balances payer convenience with security? And how can you ensure your payment operations are automated, reliable and scalable?

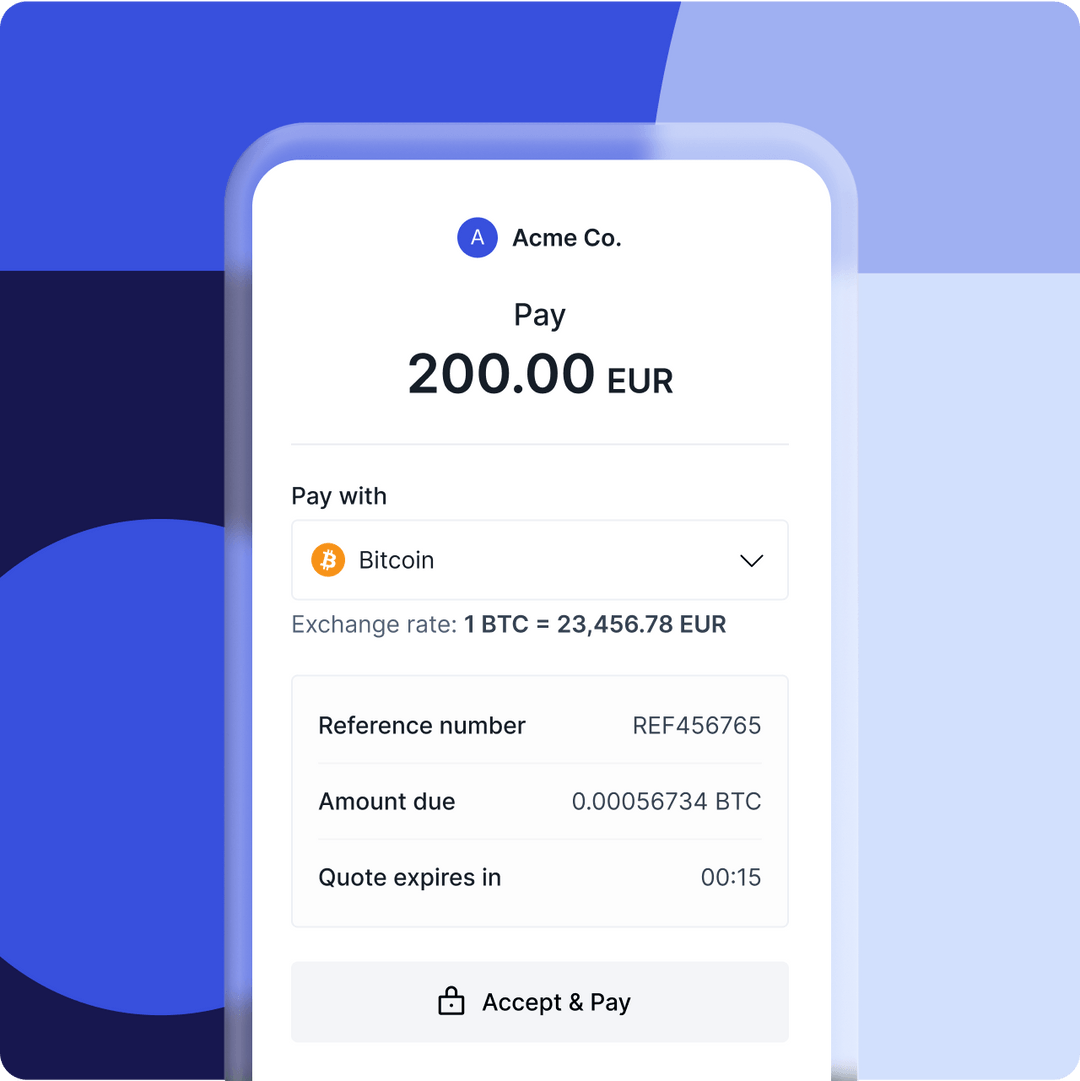

Key to solving many of these challenges, is finding the right payment gateway partner. A payment gateway, also known as a payment processor or payment provider, does the hard work of enabling you to accept payments online, creating the right customer payment experiences, while keeping your payment operations secure and compliant. With the growing popularity of cryptocurrency payments, a new raft of gateway providers have emerged, that provide the on and off ramp mechanisms from crypto to fiat currencies and provide wallet solutions needed to accept, send and convert cryptocurrencies globally.

The better the payment partner, the more your business can concentrate on your core operations and customers. So the selection criteria should be far-reaching. In this article, we’ll look at these factors, including global coverage, breadth of capabilities, ease of deployment, support, costs and compliance.

How to choose the right payment gateway for your business: 13 essential factors to consider

Businesses have lots to consider when selecting the most appropriate payment gateway processor. In this section, we’ll suggest the key criteria you should use to judge prospective service providers.

1. Fees

Have a clear understanding of how a payment gateway makes their money. Most payment processors charge a flat fee per transaction and a % of the value of the payment. This can be anywhere between 0.5%-3%, depending on the payment method, your partner and your volumes (most providers offer volume discounts). For cryptocurrency payments, expect fees around 1%. For payments which involve converting different currencies, payment gateways will often add a markup to the exchange rate. This is often a hidden cost and may on the customer at the point of transaction.

2. Processing and settlement times

Understand the service level agreements (SLAs) that a payment gateway commits to in terms of processing and settlement times. Along with fees, this can have a profound impact on customer experience and cash flow.

Processing time typically refer to how long it takes for the transaction to approved or denied. In a card payment for example, the issuing bank authorises a payment after verifying the cardholder has enough funds or credit in their account. For cryptocurrency payments, processing time is typically the time it takes for a payment to be broadcast to the blockchain network, added to a block and verified by enough nodes (usually within a few minutes).

Settlement time is usually longer. Credit and debit cards for example tend to provide instant authorisation, but funds will actually settle several days later. Direct bank payments in countries with faster payment schemes can settle near instantly, though payment involving currency conversion will likely take longer between (2-5 days), depending on the currencies involved.

If you're settling in cryptocurrencies this is near instant, but may be slowed down by the volume of other transactions being processed on the blockchain at the time. A crypto payment processor that leverages multiple blockchains can mitigate these delays. Some providers also offer to guarantee a crypto payment before the transaction has been verified on the blockchain, giving the merchant an instant response. If a business wants to settle a crypto payment into fiat, the payment gateway will need to convert the crypto and transfer the fiat across banking rails. A number of factors will influence how fast this can happen, including how quickly a settlement is initiated, and the arrangements that the payment processor has in place with banks and liquidity providers.

3. Coverage

You'll want to ensure you have the right local and global payment methods to reach your potential customers wherever they live, and maximise your revenues. As well as enabling different payment methods, gateway provider can advise you on the most appropriate payment methods for each of your markets, and create segmented checkout experiences based on these insights. In some cases you may want to integrate with specialist providers – for example to provide cryptocurrency payments.

4. Breadth of capabilities

The job of a payment gateway is not simply about moving money from A to B. It’s also about designing the optimum checkout experience, mitigating fraud, and reporting on key payment metrics, such as payment success, fraud and chargeback rates for different markets and product lines. There are benefits from accessing all these capabilities within a single, unified platform, as opposed to having to integrate multiple solutions.

5. Ease of deployment

Plug’n’play and low code deployment options, such hosted payment pages, make it easy to get started with a payment processing partner. These tend to be fast to deploy and also have the benefit of being thoroughly tried and tested, so merchants can be confident they're optimised for conversion. For merchants looking for more control over their payments, such as a customised payer experience, then APIs and developer docs will be important. In this scenario, the gateway provider should still be judged on their willingness and ability to offer guidance and support. Also look for compatibility of the payment gateway solutions with other payments, financial software and point-of-sale (POS) systems.

6. Operational simplicity

Payment systems that are difficult to work with, both from a technical and user perspective, will suck up valuable resources and budgets. Conversely, payment processes that can be automated save time and money, which can be redeployed back into the business or passed on to the customer through lower prices. AI is an increasingly important component of effective payment gateway platforms, as it enables automation and decision-making.

7. Payer experience

In today’s digital world of hyper-convenience, customers want to pay with their preferred method; 60% of ecommerce consumers will abandon their cart if they cannot pay with their preferred payment method. Payers also want simplicity. Customers who are faced with friction at the checkout, opaque costs, or concerns over security may decide not to go through with the transaction, or not return.

8. Customer support

Payments can become complex when performed at scale, especially where multiple currencies are involved in a single transaction. What’s more, ambitious merchants will want to try out new ideas that they may need help to enable. Ideally you’ll want support teams in each of your major markets, so you get round-the-clock support from experts on the ground. Also judge a payment partner by the nature of that support. Look for a provider that guarantees support through dedicated account managers and on-hand technical teams, when needed. Ask them to describe their onboarding experience, as that is usually a good barometer of the support levels you can expect going forward.

9. Compliance

Payment regulation is continually evolving around the world. While some obligations are well-understood and can be (broadly) automated (eg KYC, AML), others payment methods have less mature regulatory frameworks, such as blockchain-enabled payments that use cryptocurrencies. It’s crucial to have a payment gateway provider that keeps on top of what’s needed, has a strong risk and compliance team, and is authorised in a place known for strong regulatory oversight. Ask to see their governance and oversight framework, ask them to explain how they perform due diligence on customers and partners, and show you independent reviews on the safety and compliance of their systems and controls.

10. Transparency

Transparency is a crucial factor when selecting a new payment gateway because it ensures trust, security, and informed decision-making. A transparent payment gateway provides a clear breakdown of its pricing structure, including transaction fees and any additional costs, helping businesses accurately assess their financial commitments. Moreover, it openly communicates its data security measures and compliance with industry standards, giving customers and businesses confidence that sensitive financial information will be handled with care. Transparency also fosters accountability, allowing businesses to hold the payment gateway provider responsible for any issues or discrepancies.

11. Cultural fit

The payment gateway's values, customer service approach, and communication style should resonate with your company's culture. A good cultural fit can lead to a more cooperative and productive partnership, as both parties are likely to share similar goals and work collaboratively to achieve them.

12. Capacity for innovation

The capacity for innovation is crucial when selecting a new payment gateway because it determines a provider's ability to adapt and stay ahead in the ever-evolving landscape of digital payments. An innovative payment gateway is more likely to offer cutting-edge features, such as advanced fraud detection, alternative payment methods, and seamless integration with emerging technologies. This not only enhances the customer experience but also futureproofs your business by ensuring it can keep pace with industry advancements. Moreover, an innovative payment gateway is more likely to adapt to changing regulatory requirements, providing a secure and compliant payment processing solution.

13. Effectiveness

The ultimate test of a payment gateway is whether it works, and that the money is safe in transit. Technological resilience is important, but should be a basic requirement. Rather, businesses should be looking at metrics like payment success rates (ie the amount of payments successfully completed), broader payment journey conversion rates, fraud and chargeback rates. Businesses should also have a clear view of their risk appetite and work with a payment processor that can accommodate that.

How is BVNK different to other payment gateways?

BVNK is one of the leading cryptocurrency payment processors. We support hundreds of merchants to process billions in transactions every year. Our payments platform makes it easy for businesses to accept and send payments in 13 popular cryptocurrencies, without making changes to treasury operations. Our product has been built over many years, working with customers to understand their needs and expectations of an effective payment journey. We prioritise regulatory obligations and risk mitigation – which is why around a quarter of our team work in risk and compliance roles. With licences in Europe, the UK and South Africa, and a licensing roadmap in Africa and Asia, BVNK is placed to become one of the most regulated cryptocurrency payment processors anywhere in the world.

Wrapping up: How to choose the best payment gateway for your business

Selecting the right payment gateway can have profound influence on business success. Beyond mere transaction facilitation, a payment gateway has the power to augment customer satisfaction and act as a driver for growth. Conversely, the wrong choice can create issues throughout the payer experience, upset customers, add unnecessary operational costs, and ultimately divert budget and resources from other business activities.

Selecting a payment gateway should be a multifaceted evaluation, encompassing factors such as payment coverage, fees, security measures, seamless integration capabilities, and responsive customer support teams. A strong cultural fit is also important to establish a partnership that you can be confident will endure. If you want to enable cryptocurrency payments, make sure you select a partner with the right expertise, regulatory licenses and compliance frameworks, as well as a commitment to ongoing support team (we recently profiled 9 cryptocurrency payment gateways that can get your research started).

FAQs

Which payment gateway is best for international payments?

The best payment gateway for international payments depends on multiple factors. For example, which markets are you taking payments in, what is the preference of payers there, and what are the regulatory and compliance obligations of the jurisdiction, are just some of the considerations you should evaluate. As a basic rule, international payments are more complex than domestic payments, and so carry more risk. Payment gateways with global scale and a track record of delivery and innovation can represent a safer choice. Businesses that want to enable crypto payments should seek out a specialist payment gateway, such as BVNK.

What are the benefits of using a cryptocurrency payment gateway?

The main benefit for businesses of using a cryptocurrency payment gateway is the ability to take payments in cryptocurrency from customers or other businesses. This is important when selling products and services in countries where cryptocurrencies are popular payment methods, where the domestic fiat currency is subject to inflationary spikes, or where there are high levels of exclusion from traditional banking and payment services. Cryptocurrency payments are typically faster and less expensive to process than established bank and card networks, so merchants can also save costs and improve their cash flow position.

What’s the difference between ewallets and payment gateways?

Ewallets, also known as digital wallets or mobile wallets, are primarily used for storing payment methods and associated information. When an ewallet is used to make a payment, it simply passes this information through its app to the point of checkout. Payment gateways, on the other hand, are technology infrastructure that process the payment, including verifying the payer and payee, checking funds, routing the payment, and notifying settlement.

Which payment gateway is most secure?

Determining the "most secure" payment gateway depends on various factors, including your specific security requirements, the currencies you want to support, and your risk tolerance. When evaluating the security of a payment gateway, look for providers that implement robust security protocols, including data encryption, DDoS protection, anti-money laundering and financial crime checks, two-factor authentication (2FA), and transactions monitoring. If you're integrating the payment processing solution into your website, assess the security of the API integration, including authentication and data transmission.

How can I integrate a cryptocurrency payment gateway into my website?

There are a number of ways that a business can integrate a cryptocurrency payment gateway into its website. Many crypto payment processing providers offer low code options like hosted payment pages and/or plugins or extensions for popular e-commerce platforms like WooCommerce, Magento, Shopify. If you have a custom-built website or want more control over the integration, you can use the payment processor's API documentation to integrate it directly into your website's code. This method requires programming knowledge. With most methods, you should be able to configure the payment gateway settings according to your preferences. This may include selecting the currencies you want to accept, specifying the order status for successful payments, setting up notifications, and defining any additional payment-related parameters.

Read our guide on how to accept cryptocurrencies payments from your customers.

Accept payments in new markets

Latest news

View allGet payment insights straight to your inbox

.jpg)

.avif)

.avif)

.avif)

.avif)